oregon tax payment deadline

The Oregon tax filing and tax payment deadline is April 18 2022. Tax filing and payment due dates for individuals from April 15 2021 to May 17 2021.

The Oregon tax filing and tax payment deadline is April 18 2022.

. In most cases you must file and pay your taxes by July 15. Electronic payment using Revenue Online. After much debate and pressure from a number of accounting professional groups the Internal Revenue Service recently announced that it is pushing back the individual.

Service provider fees may apply. Choose to pay directly from your bank account or by credit card. Tax filing and payment due dates for individuals from april 15 2021 to may 17 2021.

Therefore the director has issued Directors Or der 2021-01 ordering an automatic postponement of the 2020 tax year filing and payment dates for individual Oregon taxpayers to May 17 2021. Individual taxpayers can also postpone state income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount. Oregon has not extended the due date of the first payment for its new Corporate Activity Tax CAT.

The Oregon tax payment deadline for payments due with the tax year 2019 tax return is automatically extended to July 15 2020. File your tax return anyway to avoid penalties. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

Both the filing and payment deadlines have been extended for personal income and corporate. Lets take a look at a few important dates. Estimated tax payments for tax year 2020 are not.

Even if youre unable to pay the entire tax bill you should. Corporate exciseincome or personal income. The deadline to file state and federal personal income tax returnsApril 18th and the Oregon Department of Revenue estimates that it will receive a.

On Wednesday March 25 Governor Kate Brown announced that tax payment deadlines and personal filing deadlines for Oregon would also be delayed until July 15 2020. Oregon Corporate Activity Tax payment deadline remains April 30. The Oregon Department of Revenue announced late Wednesday March 25 2020 that the state of Oregon will officially extend the deadline for certain tax payments until July.

If you have any questions the tax office is open during regular business hours. That will give them until Oct. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

The deadline for first-quarter estimated tax payments for 2020 has been extended to June 15 while the deadline for second-quarter estimated tax payments remains set at June. Estimated tax payments for tax year 2020 are not. Taxpayers must make their second payment for Oregons new Corporate Activity Tax CAT by July 31 2020.

The IRS and the respective. The tax year 2019 six-month extension to file if requested continues to extend only the filing deadline until. The Oregon tax payment deadline for payments due with the 2019 tax year return is automatically extended to July 15 2020.

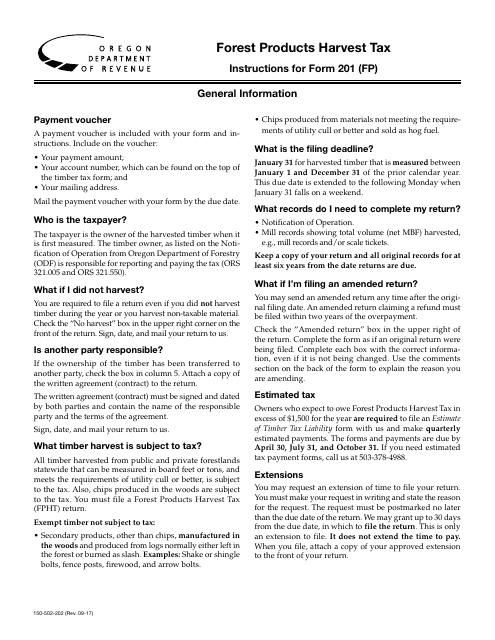

Tax Returns Due April 18th. Oregon Corporate Activity Tax payment deadline July 31 2020. April 15 July 31 October 31 January 31.

Owing money to the government can be frightening but were here to help you. Corporate Income and Excise. The Oregon Department of Revenue DOR intends to follow guidance from the IRS when.

Find IRS or Federal Tax Return deadline details. Estimated tax payments for tax year 2020 are not. Taxpayers who need more time can request an extension on the IRS website.

The due dates for estimated payments are. The Oregon Department of Revenue released more details later the same day.

E File Oregon Taxes For A Fast Tax Refund E File Com

State Local Tax Impacts Of Covid 19 For Oregon 2021 Bkd

Understanding Your Property Tax Bill Clackamas County

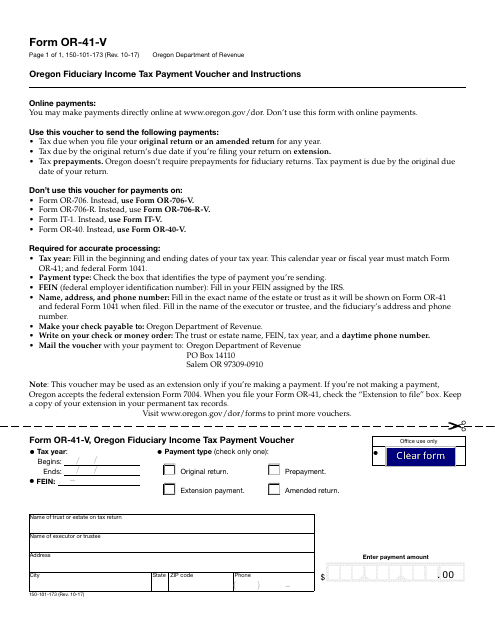

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Oregon Hoa Tax Return Filing Requirements Tips Tricks

Where S My Oregon State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Tax Office Columbia County Oregon Official Website

Oregon Ifta Fuel Tax Requirements

Oregon State Tax Software Preparation And E File On Freetaxusa

Oregon Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Oregon S Business Alternative Income Tax For Pass Through Entities Jones Roth Cpas Business Advisors

Filing An Oregon State Tax Return Things To Know Credit Karma Tax